Why Do Businesses Accept Both Credit And Debit Cards?

The days of consumers pulling out a wad of cash or upsetting others in line by writing a personal check have long since passed into the annals of history. Today's retail establishments are all about consumer convenience, minimizing fraud and leveraging existing technologies to increase sales. Credit cards have been in common use since the 1970s and debit cards offer yet another option for consumers to make purchases without having to resort to Stone Age implements like "checks" and "cash".

Convenience

Any steps that an online or brick-and-mortar retail operation can take to facilitate consumers handing over their money is bound to be embraced. Obtaining a personal credit card will always be difficult for some consumers who suffer bankruptcies, foreclosures or other adverse credit events. Debit cards are merely another tool which consumers have come to expect as a valid form of payment at numerous locations around the country and the world.

Less Fraud

Technological advancements help limit consumer fraud more so than any time in history. Stolen checks and counterfeit cash have been a plague on retailers for years. That's not to say there isn't credit card and debit card fraud but instant account verification and integrated fraud detection and prevention procedures significantly reduce the risk to retailers. When a credit card or debit card is swiped, payment processors authenticate the transaction in real-time and deny any charge that is suspicious. Debit cards are less secure but can easily be canceled if the financial institution is notified in a timely manner.

Increased Sales

If consumers have more methods to make payment for purchases, it normally results in increased sales. It's more than just basic convenience however because some consumers may not have been able to make purchases prior to using debit cards. Credit cards have been accepted online for decades even if there was a delay in payment processing. Debit cards, which are tied directly to a consumers checking account, offer similar features to credit cards when making purchases online. The number of additional possible sales by accepting debit card holders is a fair percentage greater than what is available when only accepting credit cards.

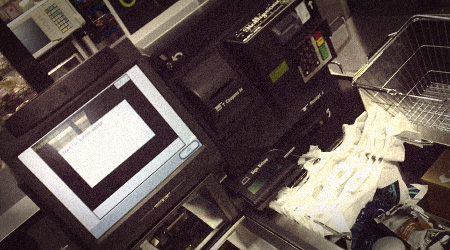

Infrastructure

You may have noticed back when consumers still used personal checks to make purchases, that the cashier would run the check through a mini scanner. It was separate from the credit card terminal and created an additional expense for retailers. By accepting debit cards, it transitions check writers to debit card users allowing the same access to checking accounts without the additional infrastructure expense. Since all payments for credit and debit cards are handled by the same network operators, it keeps processing costs down and simplifies checking out.

Alternatives

As we move into the future, even more alternatives to credit and debit cards will become available to consumers. Smart cards are already in use and their adoption increases daily, especially overseas in countries like Japan. Smart phones with NFC technology are also being used to make payments when purchasing goods and services. Internet only financial systems like PayPal also integrate with credit card networks allowing even more options for consumers and retailers alike. There's no telling what the future will bring but eventually physical forms of payment will disappear to be replaced by a universal currency.

Elsewhere on StockMonkeys.com