What Are Personalized Checks?

When opening a checking account, a customer is provided with a hand full of starter checks which contain the new account number and the bank routing number. This doesn't necessarily create a warm and fuzzy feeling since the checks are generic and void of any personal information or customization options. Personalized checks not only contain your identifying information but also reflect personal tastes or interests with a specific theme or image.

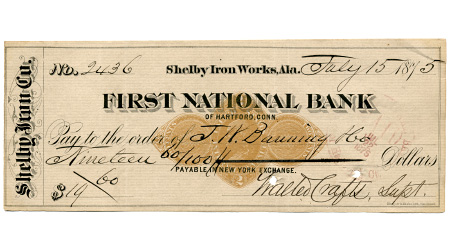

Of the three different types of checks available for new personal checking account customers, starter checks are the least interesting but most necessary. After opening a checking account, starter checks are provided because many customers may need to pay a bill or two prior to receiving their personalized checks from a bank or credit union or check printing service. Starter checks are normally a light blue or other nondescript color and contain the absolute minimum information necessary to be processed so funds can be paid to the recipient. They do not contain the customer's name, address, phone number or any other identifying information.

It is common for most new checking account holders to be offered an option by their bank or credit union to purchase checks during the account creation process. These checks normally arrive within 4 to 6 weeks, although processing can be expedited if they are needed sooner. In all honesty, this is not recommended because it is the most expensive option available to consumers when purchasing personalized checks. Prices offered by financial institutions for personalized checks are often 100% to 200% more then similar checks offered through specialty printing companies. Fortunately for consumers, as long as the checks contain the correct banking information and security features then they can be printed by any company.

The most popular option is to order personalized checks from a mail-order or online check printing company. The primary benefit is that costs tend to be significantly lower than ordering from your financial institution. It is not unheard of to pay $20 or more to a bank or credit union for the same checks you can get for 6$ as a new customer through a specialty vendor. If that wasn't enough, specialty check printing companies offer additional personalization options. Instead of a dozen or so patterns or layouts offered by your bank, customers often have a choice from hundreds of different available themes and layouts. Not only that, many will allow you to submit a photograph of your choosing such as a child or family pet to use when printing your personalized checks. Needless to say, there is literally never a reason to purchase personalized checks from your financial institution.

One important consideration to remember is that personalized checks ordered from a third-party must meet or exceed American Bankers Association standards. Various security features include micro security print which is difficult to photocopy and will be illegible. Chemical and Erasure protection which will produce discoloration, stains or spots if the check is tampered with as is often the case when trying to alter the payment amount. The back of a check will also include the text "Original Document" often in a repeating pattern limiting reproduction. As long as the check contains a lock icon to the right of the word "Dollars" then it contains all necessary security features required to protect consumers.

Elsewhere on StockMonkeys.com