What Are The Repayment Terms For A Home Equity Line Of Credit?

A home equity line of credit can be an excellent financial tool for home owners looking to use the equity in their home for other purposes. However, qualifying for and repaying a home equity line of credit can vary drastically among different financial institutions. What the loan is used for and the credit worthiness of the borrower all come into play when determining repayment terms for a home equity line of credit.

What is a HELOC?

After years of paying a mortgage, many home owners will have a substantial amount of equity built up but essentially doing nothing. Home equity is often used for consolidating outstanding high-interest rate debt from multiple credit cards, financing a small business, building an addition to their property or remodeling a part of their home. To do this they go to their lender, normally the same which holds the mortgage, and apply for a home equity line of credit.

The amount borrowed when calculating a home equity line of credit loan is normally 75% to 80% of the property's appraised value minus the outstanding balance on the mortgage. For example, if a house is appraised at $200,000 then 75% would be $150,000. If the outstanding mortgage balance is $100,000 then the borrower would receive access to $50,000 for their home equity line of credit. While the options already mentioned are the most common uses for a HELOC, there may be stipulations on the loan agreement that funds can only be used for certain activities such as a remodel or addition.

HELOC Repayment Terms

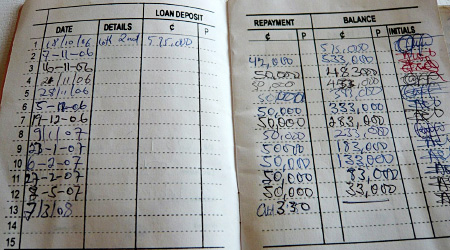

It is important to understand what a HELOC is and how can be used because this is also when repayment terms will be discussed. Repayment terms for home equity lines of credit will be different depending on the amount borrowed and the credit worthiness of the borrower. A small amount to a borrower with perfect credit may have significantly different repayment terms than a large amount to a borrower with questionable credit.

The loan term length, total amount borrowed, interest rate and how principal and interest are repaid are all factored into the repayment terms. Sometimes a HELOC is treated like a credit card with a revolving nature and an upper limit which is borrowed against and other times it is treated more like a traditional mortgage installment loan. There may also be penalties for paying more than the minimum amount per month which is what some consumers may want to do to pay off the principal sooner. In the most consumer unfriendly scenarios, some lenders may only allow the borrower to repay interest on the outstanding balance. In this case, the borrower we need to make a payment in full for the total amount used at the end of the loan term. This can be quite difficult if $20,000 has been borrowed to remodel a kitchen.

Summary

A home equity line of credit is often the best solution for most consumer's financial problems. HELOCs tend to offer the best interest rate, which also happens to be tax-deductible, with the best terms than other loan options. Not all home equity lines of credit are created equal and consumers would do well to shop around comparing repayment terms and fees. If the repayment terms are too onerous then the consumer runs the risk of foreclosure since it is collateral used to secure the line of credit.

Elsewhere on StockMonkeys.com