Is A HELOC Dischargeable In Bankruptcy?

A home equity line of credit, also known as a HELOC, is an additional loan taken against equity built up in a house and secured by the home itself. The financial institution which provides the home equity line of credit will often take a lien against the real estate to ensure that if the obligation is not repaid then they are still able to recoup all are part of the obligation if liquidation of the home is necessary.

If there is sufficient equity in the home to pay off the combined loan obligations of the first mortgage and HELOC then the combined debt will not be discharged during the bankruptcy process. Because both obligations are considered secured loans, the proceeds of the real estate sale will be used to pay off the existing loans. However, if the proceeds from sale are not enough to cover the amount owed on liens against the home then those would be considered unsecured obligations and could be discharged in bankruptcy.

In the current economic environment it has become commonplace for homeowners to lose their job or suffer other significant financial hardship. It is in the homeowners best interests to contact any creditors with which they have loans to try and renegotiate terms and lower payments if possible avoiding foreclosure. Once the process begins it tends to be an unavoidable result so all steps should be taken to prevent foreclosure.

Hopefully the HELOC and first mortgage are with the same lender which often makes it easier to negotiate payments or adjust terms to avoid foreclosure. However, if the originator of the home equity line of credit is out of state or not the mortgage holder, even if terms are negotiated to adjust mortgage payments the issuer of the HELOC would still be able to foreclose on the property for failure to repay the loan.

During the housing boom when home prices were skyrocketing, homeowners often viewed the rapid increase in the value of their home and subsequent perceived increase in equity as a piggy bank to be used for additional purposes. Unfortunately, after the crash many homeowners found themselves under water on their home loans and were not only unable to repay the existing first mortgage but any additional obligations such as a home equity line of credit. In these circumstances, bankruptcy may be one of the only options remaining to expunge these debts and move on financially.

Declaring bankruptcy should never be taken lightly as it can have significant ramifications on retaining new lines of credit such as credit cards or automobile loans. A foreclosure normally remains on a credit report for as many as seven years and a bankruptcy can be reported for up to 10 years which makes neither of them particularly appealing solutions. This is why working with the lenders if at all possible is extremely important as it can prevent affecting other areas of your financial life if negotiated terms can be agreed upon.

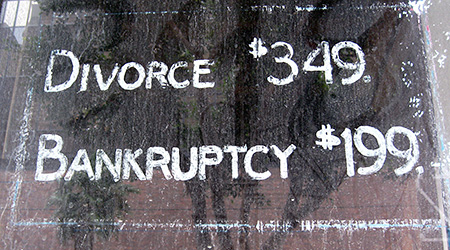

Declining home values and continued high unemployment may make bankruptcy the only option but taking steps such as consulting with a lawyer, speaking with credit counseling agencies and working with lenders are all important prior to declaring bankruptcy. There may be no other option at the end of the day but to declare bankruptcy so consult with experts to make sure it is a step worth taking.

Elsewhere on StockMonkeys.com