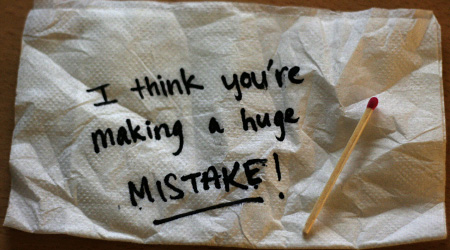

3 Financial Mistakes You Cant Afford To Make

One of the most common complaints that Americans have is that saving money is simply too hard to do in today's economic climate. But wholly neglecting to save money in a savings account -- whether on dining out with friends or by not having enough foresight to plan ahead for the future -- is a financial disaster waiting to happen.

What most people don't often consider is that saving money happens in stages, and similarly, financial mistakes happen in stages as well. In order to achieve success and sustainable financial stability, it's important to avoid making these detrimental blunders.

Today's Mistake: Paying For Nothing

Limiting unnecessary spending and holding onto limited income is an easy, yet seemingly difficult practice for consumers to accept. Gym memberships are a prime example of this kind of folly. Monthly fitness memberships sound like a good investment for a healthy lifestyle, but for whatever reason, life gets in the way of working out. As a result, members keep on paying upward of $30 per month (that's at least $360 per year) for the "right" to workout.

Some even go so far as to pay $10 per month to temporarily freeze their account instead of canceling it altogether, for the promise of being able avoid a $100 initiation fee in the future. It's all such a waste. Need to use a StairMaster? Here's a thought -- run up a staircase at the office or around the neighborhood instead for free. Are you addicted to the treadmill? Strap on your running shoes and visit a local hiking trail; the scene will be more interesting, the air fresher and your wallet will feel less bare by avoiding money mistakes like this.

Short-Term Mistake: Lacking A 9-Month Emergency Fund

At one point long ago, a three-month emergency fund was sufficient enough to handle a layoff or unexpected hospital bills. However, with the uncertainty of the job market and general economy, a more substantial rainy day fund has become essential.

28 percent of Americans don't have have any form of savings to speak of, which is an astonishing figure. While it is understandably difficult to set aside $200 a month toward a "what-if" savings account, small monthly $25 deposits can be enough to get your mentality and finances headed in the right direction.

Long-Term Mistake: Procrastinating On Retirement Savings

Planning for retirement is an often disregarded component of saving money, especially among young professionals. However, it's exactly this age when retirement savings are at their most fruitful. Depositing anywhere from 5 percent to 10 percent a paycheck at the age of 25, as opposed to 35 years-old can mean hundreds of thousand dollars more in a retirement savings account, so you can spend your golden years lounging beach-side.

For example, a 25-year-old worker making $40,000 with a 3 percent rate of inflation who plans on retiring at age 65 can save 8.1 percent of their income per year (in this scenario about $271 per month). By the time the worker reaches retirement age, their retirement fund balance would be at an incredible $1,198,803 accounting for 3 percent inflation.

However, if that same individual were to start saving for retirement at age 35, a significant loss can be found. All because the worker started 10 years too late, their total retirement balance would fall short to $890,566, but the worker would have had to commit 14.6 percent instead of the 8.1 percent of their annual income to catch up on the years lost.

Elsewhere on StockMonkeys.com